Introduction

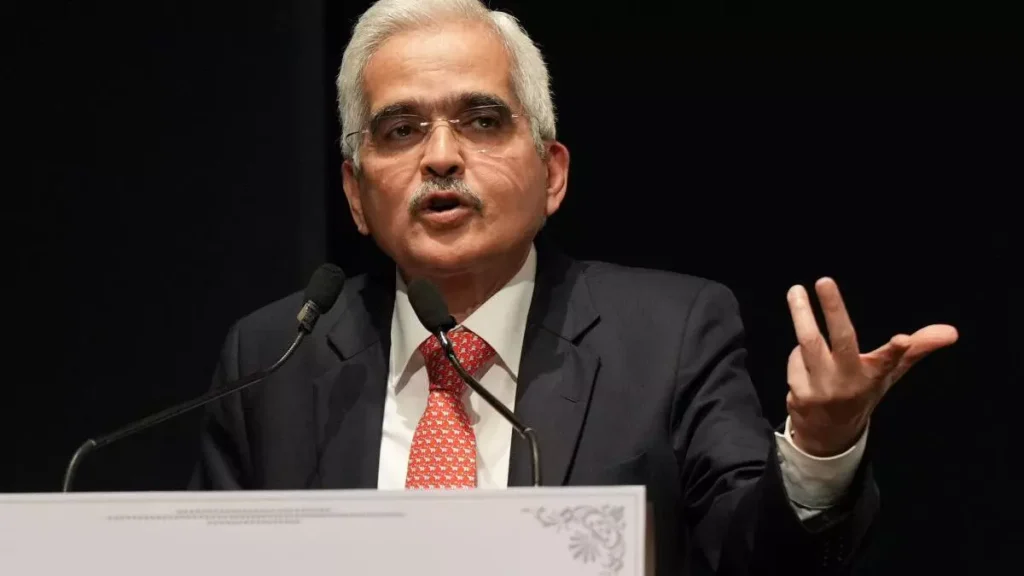

In a recent statement by the Reserve Bank of India (RBI) Governor, it has been projected that the Consumer Price Index (CPI) inflation will average at 4.5% in FY25, while the country’s economic growth is expected to surpass 7%. This projection comes as positive news for the Indian economy, indicating a promising future with steady inflation rates and robust growth. In this article, we will delve into the details of the RBI Governor’s statement, analyzing the potential impact on various sectors and exploring the factors contributing to this optimistic outlook.Understanding CPI Inflation and its Impact

- What is CPI Inflation?: CPI inflation refers to the increase in the general price level of goods and services consumed by households over a specific period. It is determined by monitoring a basket of essential items, including food, fuel, healthcare, education, and transportation.

- Factors Influencing CPI Inflation: Several factors contribute to the overall CPI inflation rate, including monetary policy, fiscal policy, global commodity prices, demand-supply dynamics, and various market forces.

- RBI’s Role in Managing Inflation: The RBI plays a crucial role in managing inflation through its monetary policy decisions. It aims to keep inflation in check while ensuring sustainable economic growth.

Positive Projections: CPI Inflation

- CPI Inflation at 4.5% in FY25: The RBI Governor’s statement predicts that the CPI inflation will average at 4.5% in the fiscal year 2024-2025. This projection suggests a relatively stable price level, which is essential for consumers’ purchasing power and overall economic stability.

- Effects on Cost of Living: With controlled inflation, the cost of goods and services will increase at a manageable rate, preventing any sudden shocks to consumers’ budgets. This stability fosters a better standard of living for the general population.

- Enhanced Business Confidence: Predictable inflation rates allow businesses to plan their operations more effectively, leading to increased investments and steady economic growth. When businesses have confidence in the economy’s stability, they are more likely to expand and create employment opportunities.

Promising Growth Outlook

- Rapid Economic Growth: The RBI Governor’s projection also indicates that India’s economic growth is expected to surpass 7% in FY25. This optimistic outlook reflects the country’s potential to rebound strongly from the economic slowdown caused by the COVID-19 pandemic.

- Contributing Factors: Factors contributing to the projected growth include government policies promoting investment, infrastructure development, digital transformation, and reforms aimed at improving ease of doing business. Additionally, strong domestic demand and the nation’s demographic advantage play crucial roles in driving growth.

- Job Creation: Robust economic growth leads to job creation, reducing unemployment rates and improving the overall socio-economic conditions. This projection presents an opportunity for the Indian workforce to secure meaningful employment and improve their quality of life.

Impact on Various Sectors

- Agriculture and Rural Development: Stable inflation and robust growth are positive for the agriculture sector, as they enhance farmers’ incomes, promote agricultural modernization, and boost rural development.

- Manufacturing and Industries: With increased investments and a growing economy, the manufacturing and industrial sectors are expected to witness substantial growth. This growth will contribute to higher production, improved infrastructure, and increased exports.

- Services and Technology: As the digital revolution continues to reshape the global economy, India’s services and technology sectors are poised to benefit from the projected growth. Greater technology adoption, e-commerce expansion, and advancements in financial technology will drive innovation and create new business opportunities.

Conclusion

The RBI Governor’s projections of CPI inflation averaging at 4.5% in FY25, along with the expectation of economic growth surpassing 7%, paints an encouraging picture for India’s economy. The stability in inflation rates and the predicted growth have the potential to positively impact various sectors, enhance business confidence, improve living standards, and generate employment opportunities. The government, policymakers, and stakeholders must continue implementing prudent measures to sustain this growth momentum while addressing any challenges that may arise along the way. FAQs- What is CPI inflation?CPI inflation refers to the increase in the general price level of goods and services consumed by households over a specific period. It is an important indicator of inflationary pressures on consumer purchasing power.

- How does the RBI manage inflation?The RBI manages inflation through monetary policy decisions, such as adjusting interest rates and regulating the money supply. The aim is to maintain price stability and balanced economic growth.

- What factors contribute to CPI inflation?Several factors contribute to CPI inflation, including global commodity prices, demand-supply dynamics, fiscal policy, monetary policy, and market forces. These factors collectively influence the overall price level.

- How does stable inflation benefit consumers?Stable inflation benefits consumers by preventing sudden shocks to the cost of goods and services. It allows individuals to plan their finances effectively and maintain a higher standard of living.

- Read more –

After Smriti Irani visited Madina, Pakistani defense affairs analyst Zahid Hamid, also known as ‘Lal Topi - Read more –

Israeli Construction Boom Beckons Indian Workers with Lucrative Package and Recruitment Drive - Read more –

Vivek Ramaswamy Quits 2024 Presidential Race, Extends Full Support to Donald Trump - Read more-

Macron Makes Bold Move: French Imams in the Crosshairs of New Anti-Radicalization Law - Read more-

Watch Live Video: 45 Tons of ‘Laddoos’ Crafted for Ram Temple Consecration in Ayodhya, India