- Indian Hotels Company Limited (IHCL): IHCL, which operates the Taj Hotels, is expected to benefit from the increased demand for accommodation in Ayodhya due to the influx of devotees. The company is building Vivanta and Ginger-branded hotels in Ayodhya, anticipating the rise in pilgrim footfall.

- Indian Railway Catering and Tourism Corporation (IRCTC): With the expected surge in the number of pilgrims, IRCTC is likely to see increased demand for its services, including trains and pilgrimage packages. The Indian Railways and IRCTC are gearing up to accommodate the growing number of visitors to Ayodhya.

- Tourism Operators: Companies such as Thomas Cook India and local operators like Apollo Sindoori are also expected to benefit from the rise in tourism to Ayodhya. The increased demand for pilgrimage packages and related services is likely to boost the prospects of these companies.

- Hospitality Sector: The hospitality sector, in general, is expected to see a positive impact, with the anticipated rise in demand for hotel accommodation and related services.

- Airlines and Aviation Sector: The Ayodhya airport is expected to become busier, and airlines are likely to see increased demand for flights to and from the city.

- Railways and Infrastructure: The Indian Railways and related infrastructure companies are also expected to benefit from the surge in pilgrim traffic, with the addition of more trains and improved facilities.

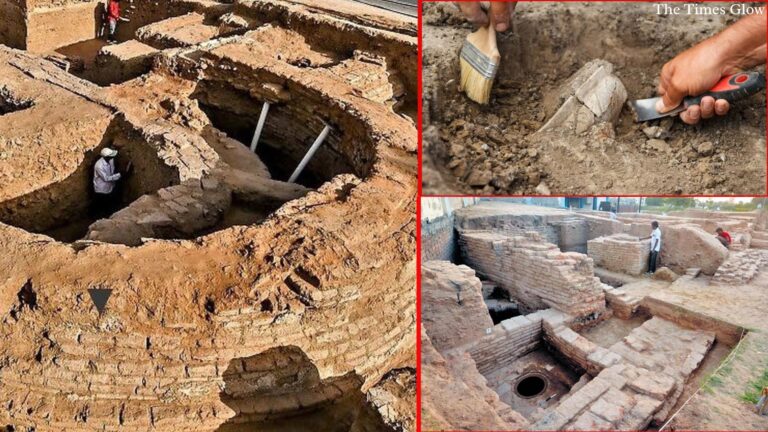

Ayodhya Ram Mandir Emerges as a New Investment Theme: 6 Stocks in the Spotlight

The euphoria over the upcoming inauguration of the Ayodhya Ram Mandir has sparked a new investing theme, with several stocks coming into focus. The historic event, set to take place in 2024, has caught the attention of investors, particularly those eyeing the potential surge in tourism and related economic activities. The anticipation of a significant increase in the number of pilgrims visiting Ayodhya has led to a rally in stocks that are expected to benefit from the surge in tourist inflow. Here are the key stocks that are currently in focus:

+ There are no comments

Add yours